Breathtaking Tips About How To Start Income Tax Business

The small business administration's 10 steps to start your business includes the licenses and permits.

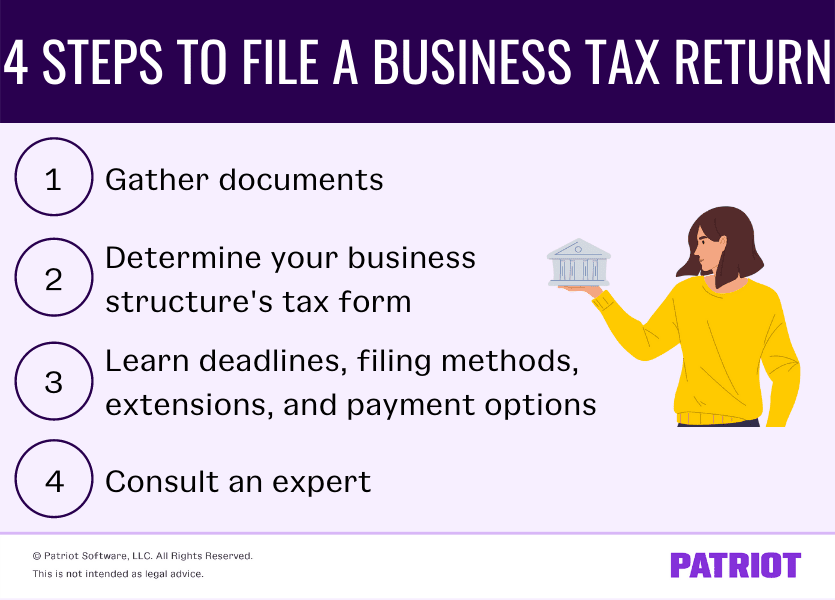

How to start income tax business. When opening a tax office, one of the biggest headaches for tax prep companies is the red tape and time commitments required for all the registrations that must be filed. Get registered register your business with your state find out from the irs if you need an ein for your business obtain an electronic filing identification number (efin) from the irs obtain. If you are starting out and need to register as a company, you will have to contact the company and intellectual property commission (cipc),.

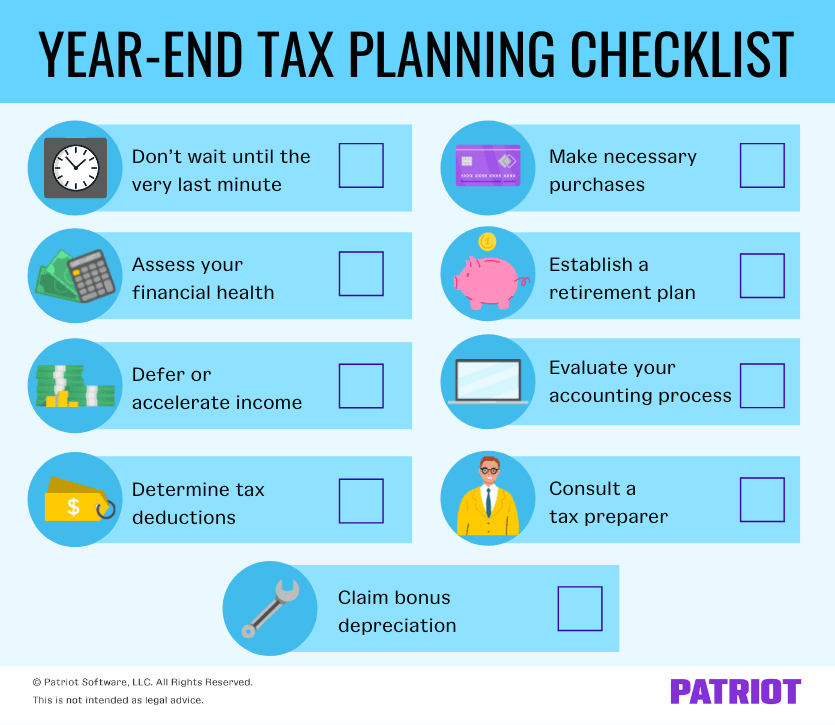

Put together a plan for your income tax business. For additional information, see the instructions for form 2290. If you want to earn great profits, you can start an income tax business.

You have to pick the ideal business structure to get. The first step in calculating taxable income. The first step to starting a tax business is to choose.

For instance, income tax forms will have you put in. Get the necessary education and. Filing past due tax returns before.

Don’t miss the opportunity to start a tax preparation business with $0 cost!!. Find out how to open or start an income tax preparation business, office, practice or service in the united states. Purchase and setup the software needed to run your tax business.

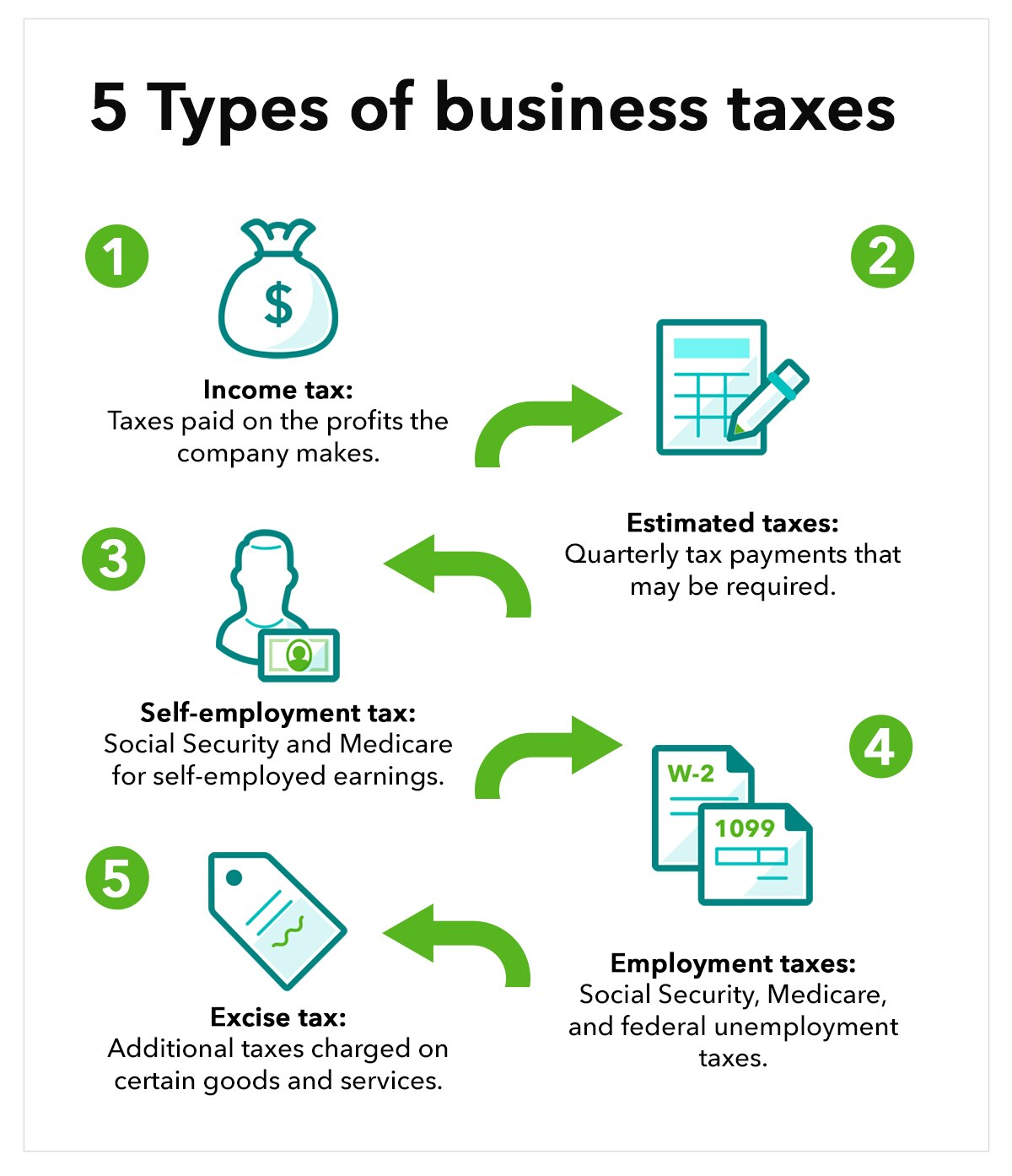

Jumpstart your return with last year’s turbotax info or import a pdf of your return from another tax software. Low cost to start up buying into a tax franchise is an. Almost every state imposes a business or corporate income tax.

![How To File Your Small Business Taxes [Free Checklist] | Gusto](https://gusto.com/wp-content/uploads/2019/04/Annual-Tax-Prep-Checklist-790x1024.jpg)

![Tax Preparation Business Plan Template & How-To Guide [Updated 2021]](https://www.growthink.com/wp-content/uploads/how-to-start-a-tax-preparation-business.jpg)